Calculate loan amount based on payment

Your principal amount is spread equally over your loan repayment term along with. The amount you want to borrow to buy the car.

Have You Tried Our Loan Calculators Yet Enter Your Desired Payment And Calculate Your Loan Amount Or Enter The Loan Amount Loan Calculator Monthly Payments

How to Use the PMT Function to Calculate Loan Payments in Excel.

. Youll need to know your interest rate the principal amount you borrowed and the term of repayment. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired.

Fixed payments paid periodically until loan maturity. Enter the current monthly payment amount. For example someone with 100000 cash can make a 20 down payment on a 500000 home but will need to borrow 400000 from the.

For larger loans. Add up all the payments of the month and then find the average by dividing the total payment by. Once you have that information you can use the formula.

Since 2010 20-year and 15-year. Loan amount 200000. For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan.

Interest Rates are calculated based off of borrowers credit scores and the amount of money being lent. A home down payment is simply the part of a homes purchase price that you pay upfront and does not come from a mortgage lender via a loan. This is the amount of money in cents determining how much the ender will collect on a dollar that is being borrowed on full term loan.

Your monthly interest rate Lenders provide you an annual rate so youll need to divide that figure by 12 the number of. If you plan to make a down payment or trade-in subtract that amount from the cars price to determine the loan amount. Choose your desired loan amount and loan term.

The choice of the method depends on the certainty of cash flows. Subtract 100000 and you end up with 82408. Given a constant payment calculate the balloon payment.

Single lump sum paid at. Multiply the number of payments over the life of the loan by your monthly payment. The calculator will tell you the average monthly payment and calculate the total interest paid over the term of the loan.

Then subtract the principal amount you borrowed. M Monthly Payment. The Bankrate loan calculator helps borrowers calculate amortized loans.

Check car prices and values when buying and selling new or used vehicles. Lets say you are shopping for a mortgage and want to know what your prospective monthly payment would be. A longer loan term will result in lower monthly.

Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full. Rates fees and charges and therefore the total cost of the loan may vary depending on your loan amount loan term and credit history. Most loans can be categorized into one of three categories.

N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage Payment Calculator. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. To calculate all you need are the three data points mentioned above.

Initial monthly repayment figures are estimates only based on the advertised rate loan amount and term entered. The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. These are loans that are paid off in regular installments over time with fixed payments covering both the principal amount.

If your down payment is 20 percent on a conventional. The initial loan amount is referred to as the mortgage principal. Actual repayments will depend on your individual circumstances and interest rate changes.

Most mortgages have a loan term of 30 years. To minimize the amount of interest paid increase the amount of your down payment and increase your monthly payments when possible. The loan program you choose can affect the interest rate and total monthly payment amount.

Enter the extra amount you can afford to add to your current monthly loan payment. To use the PMT function youll need to specify the balance interest rate and number of months over which you want to make payments. Find expert reviews and ratings explore latest car news get an Instant Cash Offer and 5-Year Cost to Own information on.

It is usually used for short term loans. P Principal Amount initial loan balance i Interest Rate. IT is the amount of dollar total of all interest payment on the loan.

Input the principal amount of the loan the period of the loan in months or years and the interest rate of the loan. Interest Rate This is the rate at which you will have to pay back additional funds for the use of money lent to you. The total monthly mortgage payment.

The easiest way to calculate total interest paid on a car loan is by using an online amortization calculator. The more money you borrow the more interest youll pay. If you would like the amortization schedule to be included in the results move the slider to Yes and select the month and enter the year you want the schedule to start at.

This is the total amount youll pay over the loans term. Monthly Payment P r1rn1rn-1 where r equals your rate n equals the number of payments and P equals the. Use the PMT function to calculate monthly payments for a loan based on constant payments and interest rates.

To calculate an installment loan payment find your loan documents. Using the example above youd multiply 50669 by 360 and get 182408. The simple loan payment formula includes your loan principal amount your interest rate and your loan term.

Then enter the loan term which defaults to 30 years. This is beginning balance in the table is the amount of dollar owed. For example if someone is certain about the short-term then method 2 can be used to determine the balloon payment based on the knowledge of payments.

The principal loan amount. To revise the minimum risk-based capital requirements and criteria for regulatory capital as well as establish a capital conservation buffer framework consistent with Basel III comments due September 7 2012 Press release and notice Extension of comment period comments due October 22 2012. The first step to determining what youll pay each month is providing background information about your prospective home and mortgage.

That is the total amount of interest. The amount of money you borrow your principal loan amount greatly influences how much interest you pay to a lender. Personal loan amounts can range from 1000 to 100000 and repayment terms are from 12 to 84 months.

Http Www Bankrate Com Calculators Savings Simple Loan Payment Calculator Aspx Calculator Design Loan Calculator Loan Amount

Simple Loan Calculator For Excel Loan Calculator Mortgage Calculator Car Loan Calculator

A Mortgage Calculator Is A Tool That Allows You To Calculate A Monthly Repayment Using Variables Such As Loan Amount Loan Amount Mortgage Calculator Repayment

Simple Interest Loan Calculator For Excel Simple Interest Loan Calculator Amortization Schedule

Playing With A Bank Loan Calculator Calculator Design Loan Calculator Web App Design

Mortgage Payment Calculator Loan Amount 175000 Interest Rate 2 5 Loan Term 25 Years Mortgage Payment Mortgage Payment Calculator Loan Amount

Emi Calculator For Personal Loan Personal Loans Loan Consolidation Loan

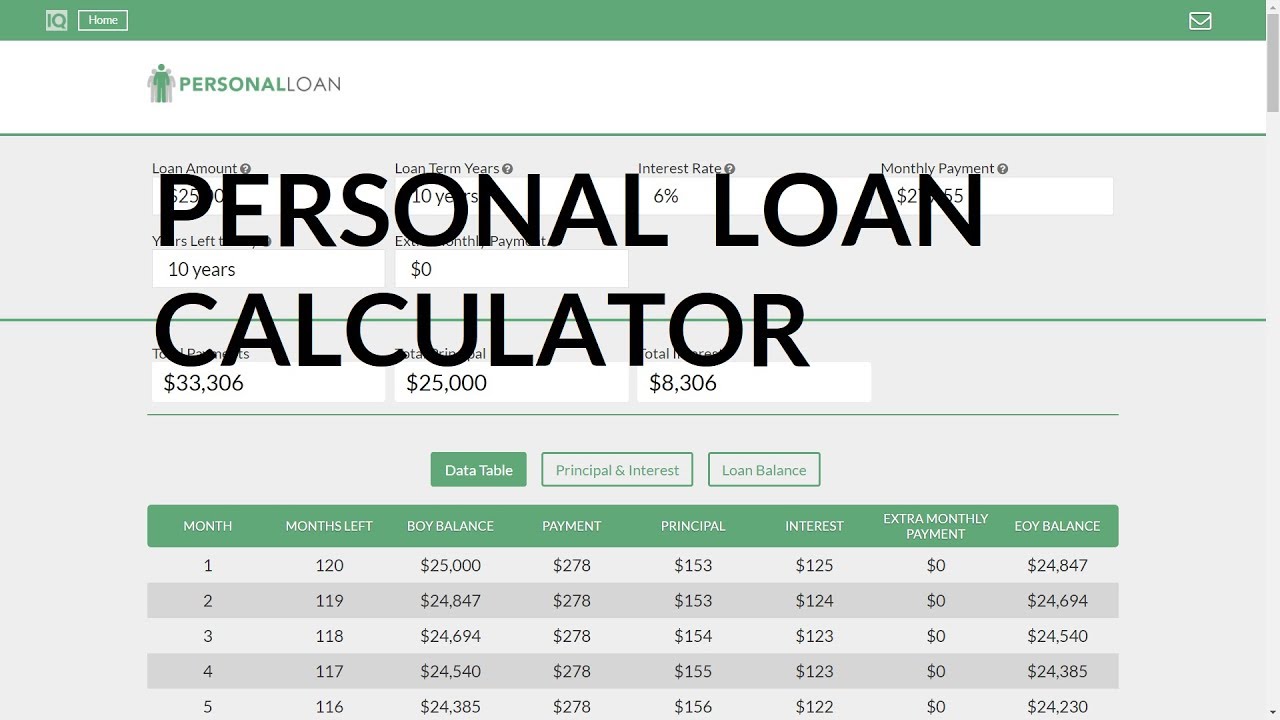

Loan Calculator For Personal Loans Personal Loan Payments Calculator Personalloans Debt Personal Loans Loan Calculator Loan

Home Affordability Calculator To Determine How Much House You Can Afford Based Of Mortgage Amortization Calculator Mortgage Calculator Mortgage Calculator App

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

Loan Payment Calculator Https Salecalc Com Loan Loan Payment Calculator

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Payment Calculator Mortgage Payment Mortgage

Printable Mortgage Calculator In Microsoft Excel Mortgage Payment Calculator Mortgage Calculator Mortgage Payment

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Mortgage Calculator Calculate Mortgage Payment Tables And Total Costs Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan